Why is it Important to Reconcile Your Bank Statements?

Reconciliation of your why is it important to reconcile your bank statements? is a crucial financial process that involves comparing the transactions recorded in your financial records with those listed on your bank statement. Whether for personal or business accounts, regularly reconciling your bank statements helps ensure that your financial records are accurate, up-to-date, and free of errors. By doing so, you can identify discrepancies, detect potential fraud, and manage your finances effectively. This article will delve into the importance of reconciling your bank statements, the step-by-step process, benefits, risks, and best practices for effective reconciliation.

Table of Contents

- Introduction to Bank Reconciliation

- What is Bank Reconciliation?

- Why is Bank Reconciliation Important?

- Who Should Reconcile Bank Statements?

- The Process of Reconciling Bank Statements

- Step-by-Step Guide to Bank Reconciliation

- Tools for Bank Reconciliation

- Benefits of Reconciling Your Bank Statements

- Accuracy and Error Detection

- Fraud Prevention

- Budgeting and Financial Control

- Improved Financial Planning

- Enhanced Business Transparency

- Risks of Not Reconciling Your Bank Statements

- Financial Mismanagement and Mistakes

- Increased Risk of Fraud

- Missed Payments and Overdraft Fees

- Legal and Compliance Issues

- Lost Control Over Cash Flow

- Bank Reconciliation for Individuals vs. Businesses

- Reconciling Personal Bank Statements

- Reconciling Business Bank Statements

- Challenges Faced by Businesses in Bank Reconciliation

- Common Challenges in Bank Reconciliation

- Dealing with Discrepancies

- Handling Complex Bank Statements

- Time and Resource Constraints

- Best Practices for Effective Bank Reconciliation

- Regular Reconciliation Schedule

- Organizing Financial Records

- Leveraging Technology for Automation

- Double-Checking for Missing Transactions

- Tools and Software for Bank Reconciliation

- Popular Accounting Software for Bank Reconciliation

- How Automation Can Help Streamline the Process

- Pros and Cons of Using Software Solutions

- Conclusion

- The Importance of Regular Bank Reconciliation

- Final Thoughts and Best Practices

Introduction to Bank Reconciliation

What is Bank Reconciliation?

Bank reconciliation refers to the process of comparing the transactions recorded in your personal or business financial records with those listed on your bank statement. The goal of reconciliation is to ensure that both records match and to identify any discrepancies, such as errors or fraudulent activities, that may exist between the two.

Bank reconciliation is a vital aspect of accounting because it ensures the accuracy of financial reporting, reduces the risk of mistakes, and improves financial decision-making. In simple terms, it’s about confirming that the money you think you have matches what your bank says you have.

Also Read: niva followers

Why is Bank Reconciliation Important?

Reconciliation is crucial for several reasons. First, it provides an opportunity to verify that all transactions were properly recorded, which helps avoid discrepancies in your financial statements. Second, it offers an early warning system for detecting fraudulent activities and bank errors. Third, regular reconciliation helps businesses and individuals maintain financial control, avoid overdraft fees, and plan more effectively for future expenses.

Inaccurate bank records can lead to financial mismanagement, including missed payments, overspending, or even legal complications. By reconciling your bank statements on a regular basis, you ensure that these risks are minimized.

Who Should Reconcile Bank Statements?

Reconciliation is necessary for both individuals and businesses.

- Individuals: For personal finances, bank reconciliation helps ensure that the household budget is accurate, and that savings and investments align with financial goals.

- Businesses: Businesses of all sizes—whether small, medium, or large—need to reconcile their bank statements to track cash flow, manage expenses, and maintain compliance with tax and financial reporting requirements.

The Process of Reconciling Bank Statements

Step-by-Step Guide to Bank Reconciliation

The process of reconciling a bank statement involves a few key steps:

- Obtain Your Bank Statement:

- Download or receive the bank statement from your bank for the given reconciliation period. It will contain a detailed list of all transactions, including deposits, withdrawals, fees, and interest earned.

- Prepare Your Records:

- Gather your internal financial records or checkbook register. This should include all transactions that you’ve made, such as checks written, payments made, and any deposits or transfers.

- Compare Deposits:

- Match each deposit on your bank statement with those recorded in your financial records. Ensure that the amounts and dates are identical.

- Match Withdrawals and Payments:

- Cross-check each withdrawal, check, debit card payment, or automatic withdrawal listed on your bank statement with the transactions in your records.

- Identify Discrepancies:

- If you find any discrepancies, such as a missing deposit or an extra charge, note these differences. Common reasons for discrepancies can include outstanding checks, unrecorded fees, or transactions that have not yet cleared the bank.

- Make Adjustments:

- After identifying discrepancies, update your financial records accordingly. For instance, you may need to account for an outstanding check or bank charges that weren’t previously recorded.

- Ensure the Ending Balances Match:

- After all adjustments are made, check that your adjusted book balance matches the adjusted bank statement balance. If the two balances agree, the reconciliation is complete.

Tools for Bank Reconciliation

While manual bank reconciliation is still widely used, several tools and software can help streamline the process. Popular tools and software solutions include:

- QuickBooks: Ideal for businesses, QuickBooks offers automatic bank feeds and reconciliation features to match transactions seamlessly.

- Xero: Known for its user-friendly interface and cloud-based accounting, Xero also offers automatic bank feeds and reconciliation features.

- Mint or YNAB (You Need a Budget): Great for personal finances, these tools help track spending, categorize transactions, and reconcile accounts.

Using these tools reduces the time spent on manual reconciliation and minimizes the chances of human error.

Benefits of Reconciling Your Bank Statements

Accuracy and Error Detection

Regular bank reconciliation ensures that your financial records are accurate. It helps catch errors early, such as:

- Bank Errors: Mistakes made by the bank in processing transactions.

- Input Errors: Mistakes made when recording transactions in your own records.

- Duplicate Entries: Payments or deposits recorded more than once.

Catching these errors early helps avoid larger discrepancies down the road, and ensures that you have an accurate picture of your finances at any given time.

Fraud Prevention

One of the main reasons to reconcile your bank statements regularly is to identify fraudulent activity. Unauthorized transactions, such as charges made on your credit cards or bank accounts without your knowledge, can be detected during reconciliation.

By regularly reviewing your transactions, you can spot suspicious activity and take immediate action to report it to your bank, limiting the potential damage.

Budgeting and Financial Control

Reconciling your bank statements regularly helps maintain financial control. For businesses, it is crucial for effective cash flow management, ensuring that you can pay bills on time and avoid overdrafts. For individuals, reconciling helps track personal expenses, identify areas of overspending, and stick to a monthly budget.

Improved Financial Planning

Having accurate, reconciled records enables better financial planning. Whether for personal savings or business investments, knowing exactly how much money you have available allows for more effective decision-making and forecasting.

Reconciliation can also help identify recurring payments, such as subscriptions or automatic payments, that can be adjusted or eliminated to save money.

Enhanced Business Transparency

For businesses, regular bank reconciliation improves transparency and trust. Investors, stakeholders, and auditors all expect accurate financial records. Businesses that can show a history of accurate and timely reconciliations are more likely to gain the trust of investors, improving their financial reputation.

Risks of Not Reconciling Your Bank Statements

Financial Mismanagement and Mistakes

Failure to reconcile your bank statements regularly can result in significant financial mistakes. Without regular checks, you may overlook small errors that, over time, could snowball into larger issues. This might lead to missed payments, inaccurate financial reports, or overspending.

Increased Risk of Fraud

Without reconciliation, fraudulent activities may go unnoticed. If a fraudulent charge is posted to your bank account and you don’t notice it in time, you may be unable to recover the stolen funds. By reconciling frequently, you can spot unauthorized transactions early and report them to the bank before significant damage is done.

Missed Payments and Overdraft Fees

Neglecting reconciliation increases the likelihood of missed payments, resulting in penalties, late fees, and overdraft charges. These fees can add up over time, especially for businesses with multiple transactions each day.

Legal and Compliance Issues

For businesses, failing to reconcile bank statements regularly can lead to compliance issues. Financial misreporting, due to untracked discrepancies, can lead to audits, penalties, and potential legal consequences, particularly if taxes or regulations are involved.

Lost Control Over Cash Flow

For businesses, especially, losing control of cash flow is a major risk when bank statements are not reconciled. When cash flow is not accurately tracked, it becomes difficult to plan for future expenses, take advantage of opportunities, or ensure that the business remains solvent.

Bank Reconciliation for Individuals vs. Businesses

Reconciling Personal Bank Statements

For individuals, reconciling bank statements is an essential habit for managing personal finances. It helps track spending, manage debt, and ensure that savings are growing as planned. For those using budgeting apps, reconciling with the bank statement helps to double-check spending categories and financial goals.

Reconciling Business Bank Statements

For businesses, bank reconciliation is a more complex task, especially when handling multiple accounts or high volumes of transactions. Businesses need to reconcile bank accounts to maintain accurate records, control cash flow, and ensure compliance with tax laws and regulations.

Reconciliation for businesses often involves handling:

- Payroll transactions

- Accounts payable and receivable

- Vendor payments and customer deposits

Challenges Faced by Businesses in Bank Reconciliation

Businesses may face challenges such as managing multiple bank accounts, reconciling transactions across different systems, or tracking international transactions. Larger businesses also need to ensure that reconciliations are performed across departments, requiring coordination and efficiency.

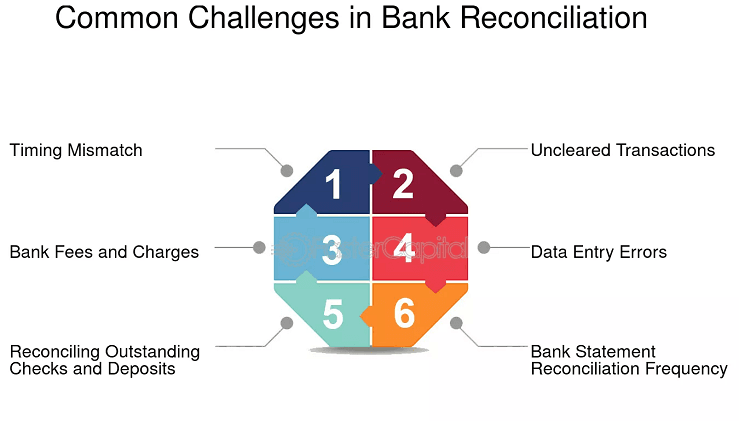

Common Challenges in Bank Reconciliation

Dealing with Discrepancies

When reconciling, you may encounter discrepancies that need to be resolved. These can include bank fees that weren’t recorded, deposits that haven’t cleared, or errors in your accounting records. Resolving these discrepancies can be time-consuming, but it is crucial to ensure the accuracy of your financial records.

Handling Complex Bank Statements

For individuals or businesses with complex transactions—such as multiple accounts, frequent international transfers, or high transaction volumes—reconciliation can be more challenging. Special care is needed to accurately match every transaction.

Time and Resource Constraints

For businesses, bank reconciliation can be resource-intensive, particularly if done manually. Larger companies may need a dedicated accounting team or external auditors to ensure that reconciliations are completed accurately and on time.

Best Practices for Effective Bank Reconciliation

Regular Reconciliation Schedule

Establishing a regular reconciliation schedule is essential. For individuals, reconciling monthly is often sufficient, while businesses may need to reconcile weekly or even daily depending on the volume of transactions.

Organizing Financial Records

Keeping your financial records organized helps streamline the reconciliation process. Ensure that receipts, invoices, and other supporting documents are readily available and categorized correctly.

Leveraging Technology for Automation

Using accounting software like QuickBooks, Xero, or FreshBooks can automate much of the reconciliation process, reducing errors and saving time. These tools sync directly with your bank account, allowing for faster and more accurate reconciliations.

Double-Checking for Missing Transactions

Before finalizing the reconciliation, make sure that no transactions have been overlooked. Outstanding checks, bank fees, or pending deposits should be carefully accounted for.

Tools and Software for Bank Reconciliation

Popular Accounting Software for Bank Reconciliation

- QuickBooks: Widely used for business and personal finances, QuickBooks offers a user-friendly reconciliation feature that connects directly to your bank accounts.

- Xero: A cloud-based accounting software with an intuitive reconciliation system, ideal for small businesses.

- Mint: Popular for personal finance management, Mint helps individuals track spending and reconcile their bank statements.

How Automation Can Help Streamline the Process

Automation tools can help reduce the manual effort needed for reconciliation by importing transactions directly from your bank account and automatically matching them to your records. This not only saves time but also minimizes the chances of human error.

Pros and Cons of Using Software Solutions

Pros:

- Faster reconciliation

- Reduced errors

- Access to real-time financial data

Cons:

- Subscription fees for software

- Learning curve for new users

Conclusion

Reconciliation of bank statements is an essential practice for both personal and business finances. By ensuring accuracy, detecting fraud, managing cash flow, and providing transparency, regular reconciliation keeps your financial records in good shape. Whether you handle your finances manually or through automation tools, ensuring that your bank statements match your internal records is a critical step in maintaining financial integrity.

Incorporating best practices, leveraging technology, and sticking to a regular reconciliation schedule can greatly improve financial management and contribute to long-term financial health.